Idaho offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

Rebates and Incentives

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Idaho State Capitol

700 W Jefferson St,

Boise, ID 83702

(208) 332-1012

Hours: M-F 8:00am-5:00pm

Saturdays & Holidays 9:00am-5:00pm

Idaho Power

P.O. Box 70

Boise, ID 83707

Treasure Valley: (208) 388-2323

Toll-Free: (800) 488-6151

Hours: M-F 7:30am-6:30pm

Energy Division

Idaho Governor’s Office of Energy and Mineral Resources

304 N. 8th Street, Suite 250

Boise, ID 83702

Phone: (208) 332-1660

Fax: (208) 332-1661

Richard Stover, Administrator

Phone: (208) 332-1671

Email: [email protected]

Hours: M-F 8:00am-5:00pm

Boise Weather Bureau

3833 S. Development Ave. Bldg 3807

Boise, ID 83705-5354

Phone: (208) 334-9860

Email: [email protected]

Hours: M-F 8:00am-6:00pm

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

| 2006-2032 | max $1,200 | Purchases made in 2023 – 2032 with the exception of some technologies |

| Energy Tax Deduction | max $20,000 | This can be applied in the year that the energy system is installed |

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

Idaho Clean Energy

Energy Efficiency

Energy Loan Program

Energy Resiliency Grant Program

Energy Efficiency and Conservation Block Grant Program

National Electric Vehicle Infrastructure Program

Heating Assistance

Weatherize Home

Power Outage Map

Idaho Department of Environmental Quality

1410 N. Hilton St.

Boise, ID 83706

(208) 373-0502 or (866) 790-4337

Boise Regional Office

Coeur d’Alene Regional Office

Idaho Falls Regional Office

Lewiston Regional Office

Pocatello Regional Office

Twin Falls Regional Office

Idaho solar incentives make the Gem State an excellent choice for those considering solar energy solutions for their home or business.

In fact, residents can register for a number of Energy Efficiency and Renewable Energy (EERE) programs in the state, which reduce the cost of solar panel installation.

Idaho Solar Credits Overview

The state offers solar incentives, tax deductions, net metering, a broad range of solar technology, easy access to renewable energy supplies, and more, all in the interest of lowering the cost of solar systems to spur adoption.

This complete guide provides the options available for residents who want green energy systems in Idaho, and the step required to enroll in the various rebates and programs.

The average cost of purchasing a solar system including installation in Idaho for a 5 kW to 10 kW solar energy system is between $14,850 to $29,700, but this can be higher or lower depending on your electricity requirements.9

That is a significant investment that not every householder will be able to afford, yet the local government wants every house and business owner to have a solar panel system, or other renewable energy resources, in their home.

There are 3 reasons for this.

Number 1: The electricity grid across Idaho is often under pressure at peak usage times, and every year the system experiences blackouts for about 5 to 6 hours. The installation of solar panels on more residential rooftops and on commercial properties will lessen the strain placed on the grid.

Number 2: Solar panels are a renewable power source that is incredibly beneficial for the planet and is at the forefront of fighting climate change.

Number 3: After the payback period has elapsed, which is about 12 to 14 years in this state, the solar panel will have recouped the initial expenditure in savings on your utility bills.9

To make that dream a reality, Idaho has introduced a range of solar tax credits that can save up to 40% off the overall price in the first year of installation and a further 20% for the next 3 years.10

There are other smaller rebates that can be claimed, as well as net metering that helps the system to pay for itself, and not to forget the Federal Solar Investment Tax Credit that has been extended under the government’s Inflation Reduction Act that will save another 30%.1

How Solar Credits Work With Taxes

So how do you find out all the information on solar power credits?

Your solar panel installer will be able to point you in the right direction, or you can look online to gather any more information about Idaho solar incentives.

To get you started, here are the credits you can apply for, and the documentation required.

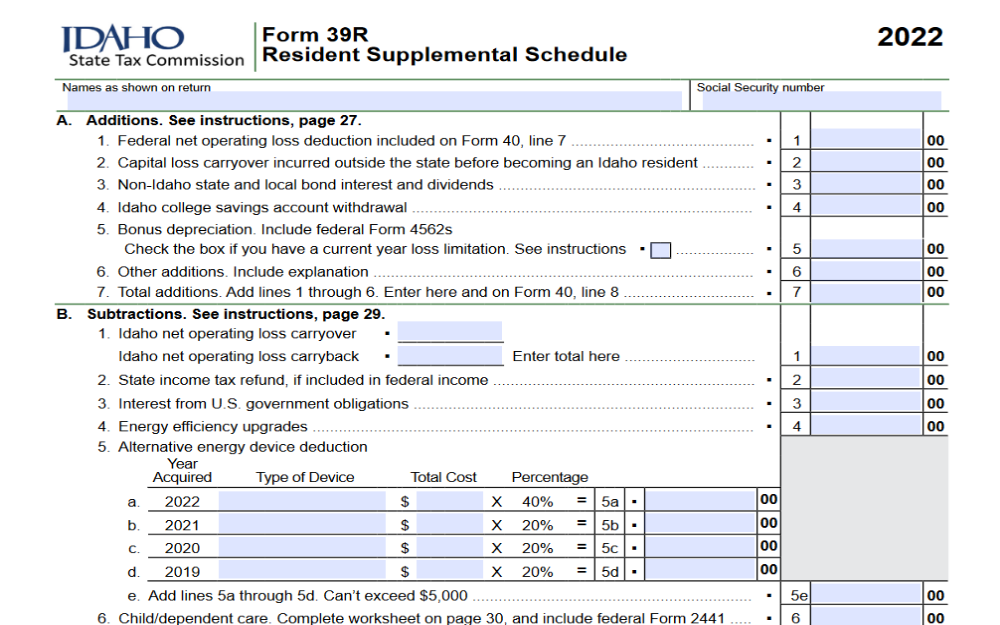

Idaho Residential Alternative Energy Tax Deduction

The Residential Alternative Energy Tax Deduction in the state of Idaho is one of the best programs available.

With the possibility of being able to deduct up to 40% from the first year when the solar panels are installed and then 20% thereafter for the next three years. But there are caveats.

- You will only be able to claim a maximum of $5,000 every year or a total amount of $20,000 over the course of the 4 years.

- As a tax reduction program, the money you save will be deducted from your yearly taxes. For example, if you had a tax liability of $6,000 but claimed the full $5,000 allowed in that year under the incentive program, you would only have a tax bill of $1,000.

- Full-year residents can fill out section B of Idaho Supplemental Schedule 39R and then complete Form 40 with the same number.

- Form 39NR, section B, is used for non-residents or for a partial tax year and then the same number is transferred to Form 43.

- To be eligible for claiming this Idaho solar tax deduction you either have to be in work or in a scenario where you owe taxes that the discount can be subtracted from.

Federal Solar Tax Credit (ITC)

A solar tax credit is available in the United States that can offset up to 30% of the initial investment in a photovoltaic system.

Officially called the Residential Clean Energy Tax Credit, it works similarly to the Residential Alternative Energy Tax Reduction in that the 30% is discounted from your taxes due for that year.

The difference is that the entire amount can be claimed in one year if your tax liability is big enough.

For example, from a quote of $26,000, you will be eligible for a tax credit of $7,800. That can be claimed either in one go or yearly up to a maximum of 5 years until the amount is exhausted.

- If in the first year, your tax due is only $1,800 then the balance of $6,000 will be carried over to the following year and you will have no taxes to pay for that year. This rollover continues for 5 years in total but it’s important to remember that if at the end of the term, there is an unclaimed amount then it will be forfeited.

- The program will come to an end in 2034. Before then the 30% will be reduced to 26% in 2033, and then in the final year to 22%.

However, unlike the state-level tax deduction, not everyone is eligible for this tax credit for solar photovoltaics (PV).2

- You have to be the owner of the premises where the solar system is installed, and it has to be in the United States. That’s not to say that it has to be bricks and mortar.

According to the IRS website, that property can be an apartment in a complex, a mobile home, a condominium, or even a houseboat. As long as you’re the registered owner. - To qualify you have to be the owner of the system. That means it cannot be leased or rented, but it will qualify if it has been purchased by a loan agreement.

Applying for the Federal Solar Tax Credit (ITC) couldn’t be easier and your tax advisor will walk you through how to fill in IRS Solar Credit Tax Form 5695 with all the information about the system provided by your solar installer.13

- Get the Form: You can download Form 5695 from the official website of the Internal Revenue Service (IRS) or obtain a copy from a tax professional.

- Gather Your Information: Before you start filling out the form, make sure you have all the necessary information, including receipts and records related to your solar energy system installation. You’ll need details such as the cost of the solar panels and installation.

- Personal Information: At the top of the form, you’ll need to provide your personal information, including your name, Social Security Number (or Taxpayer Identification Number), and address.

- The Rest of the Form: Fill out the rest of the form in accordance with the instructions listed on the form.

What Forms Do I Need To Fill Out To Get the Credit?

To apply for the Residential Alternative Energy Tax Deduction you need to fill out section B of Idaho Supplemental Schedule 39R and then complete Form 40 with the same number, and for the Federal Solar Tax Credit (ITC), you need to fill out Form 5695.14,15

To be eligible for these credits:

- The property has to be within the United States, for the Residential Alternative Energy Tax Deduction, within the boundary of Idaho, and has to be your main residence.

- The applicant has to be the registered owner of the property.

- As discounts are offset against tax liabilities, taxes have to be owed.

- The solar system has to be purchased. It cannot be leased or rented.

Details on the forms have to include the address where the photovoltaic system is installed as well as a few other details.

- On the first line, fill in the total cost of the system minus any discounts from incentive programs.

- On lines 2 to 4 include any other green improvements you have made to the premises. Add up the total of all the lines, 1 to 4, and place that figure on line 5.

- Multiply that figure on line 5 by the 30% discount and place that on line 6.

- Then go to line 13 and calculate your tax liability.

- Complete the worksheet on page 4 to find out how much you will be credited.

- Enter that amount on line 14, and then enter the amount from that line or from line 13, whichever is smaller, onto line 15.

- To determine any remaining credit, review your tax credits against your tax due and subtract the amount on line 15 from 13.

This will show the amount you may deduct from next year’s taxes if your tax burden is lower. Copy the answer down to line 16. - The amount you entered on line 15 will be the tax credit you will receive from the IRS in that particular year.

How Can Home Solar Reduce Your Electricity Bills?

Getting solar panels for free is unfortunately not possible, and neither is getting used solar panels for free. But a Power Purchase Agreement and net metering programs come pretty close and will save you a lot of your hard-earned money in the short, medium, and long term.

So how do they work? And is there a deadline for applying for tax credits?

Power Purchase Agreement

A Power Purchase Agreement is essentially a contractual agreement where a third party,5 such as the solar company, agrees to install a complete solar system in your home at little or sometimes no upfront cost.

The cost of the electricity produced by the system is sold to the customer at a rate lower than the retail rate charged by the local utility company, meaning that your utility bills are less than what they used to be, while the developer benefits from the tax credits and other incentives as the owners of the solar system.

These PPAs may last anywhere from 10 to 25 years, and during that time, the system will be operated and maintained by the developer.

At the end of the term, you will have the option of purchasing the system or renewing the contract.

Net Metering

With net metering, money is immediately saved off the top of the quote because a battery storage panel is not required, and you can still take advantage of all the available Idaho solar incentives.

Unlike PPAs, you do have to purchase the complete system and sign an agreement with your local grid to sell them back excess electricity that your property does not utilize.

A smart meter will be provided that automatically calculates the amount of electricity generated by your system, how much is consumed, and how much is sent back to the grid.

Credits are given for every kilowatt and if the power demand of the property exceeds the system’s production, such as at night or during cloudy days, the electricity meter will run backward to offer a credit against what electricity is spent.

The monthly utility bill will reflect the readings from the smart meter and will show how much if any payment will be required.

Either of these two options saves money. With PPAs, there are either low or no-money-down options, while with net metering the cost of a battery storage system is eliminated to reduce the overall cost, and utility bills are reduced.

Dominion Energy: ThermWise Residential Energy Efficiency Rebate Programs

These are a group of solar programs that promote the installation of energy-saving home appliances and systems, including solar systems.16

Credits and extra funding of $750 or more will be available via some of the solar programs, as long as you are a registered customer.

There are no deadlines for applying for any of the credits apart from the Federal Solar Tax Credit (ITC) for businesses or residential properties,6 of which will come to a conclusion at the end of 2034.

Home Solar Installation Expenses and Materials

When you first start researching solar panels for house rooftop installation, you will probably find that the prices can vary between suppliers. It can be confusing and a little daunting, especially when the quotes can differ by as much as $5,000 or even $10,000.

Even when Federal solar incentives are deducted, the variance is still there and you can be left out of pocket. And there’s nothing worse than purchasing the same exact system as your neighbor – but you’ve paid $5,000 more.

A solar estimate is just that.

Solar installers, Idaho or in any other state, will provide a quote for you based on the information you give them. To give an accurate price, a home visit would ideally be required but before getting to that stage you can gather all the necessary information they will need to get a fairly accurate price.

- The first thing to know is how much electricity your home is consuming. Your utility bill will have a breakdown of how much you’re paying per kilowatt and per month.

With this information, your solar provider can calculate the size of the solar energy panel you need to generate the same amount of electricity.

For residential properties, the power output of the solar array can range from 3kW, 4kW, 5kW, 6kW, up to 10kW which is the average size in Idaho. The larger the system, the higher the price. - The size of your property, the occupants, and even the appliances and times that they are used will reflect on the size of your utility bills. Perhaps you have a backyard jacuzzi, and air conditioning units that are constantly on, or you regularly charge your electric vehicle at home.3

These items would require more power and more solar panels to run and could account for the discrepancy between the price you have been quoted compared to your next-door neighbor’s. - When the decision has been made to go solar, gather all the information that relates to power consumption in your house to get the most accurate quote possible.

There will be other factors that will influence the price, however, one of which is simply the quality of the solar panels.

They are:

- The types of solar panels; monocrystalline, which is more efficient at energy conversion, or polycrystalline which is cheaper.

- Is a battery bank required to store excess energy? On cloudy days or at night, this stored energy can be used and then replenished when the sun is next out.

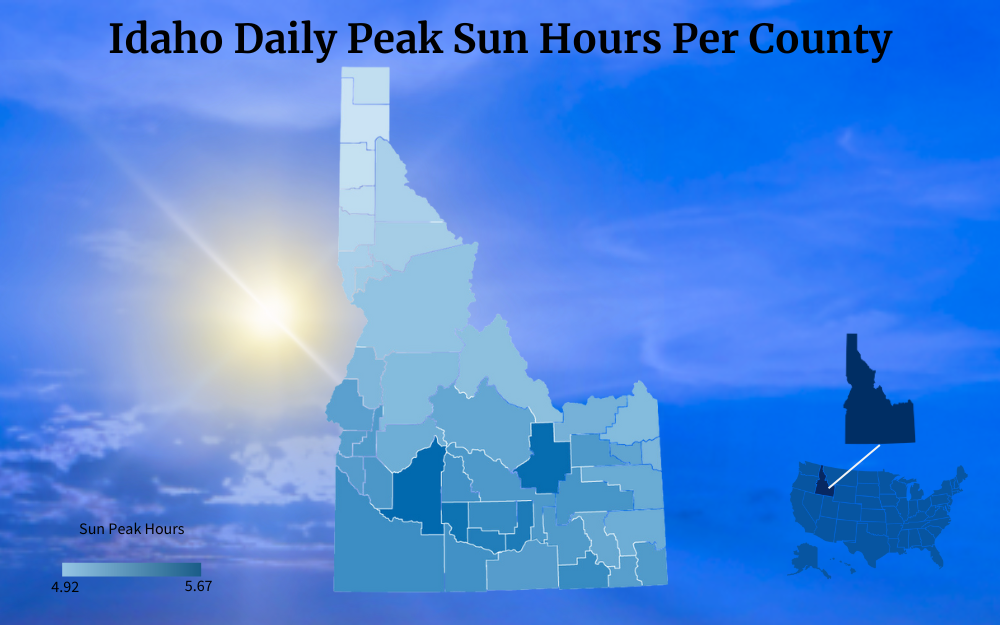

The average peak sun hours in Idaho is 4.92 hours a day compared to 5.67 in Florida, and this determines how much solar energy can be captured by your solar panels home system.

A battery array can add between $1,600 to $6,000 to the price. - The size of the inverter

- The racking system used for the rooftop installation. But you may also ask, What if the solar panels are not on my roof?

If you have sufficient land space available around your home, they can be installed there as long as there are no overhead obstructions blocking the sunlight. - Labor costs will not be the same for every solar provider. On average the cost per worker can range from $390 to $305 per day.11

There are generally 2 people required to complete the installation over 1 or 2 days. - Any state or local permits will have to be paid for and they will be listed separately on your contract, along with the cost of the final inspection fees after the installation is completed.

- Soft costs like marketing and sales are also included.

- And, of course, there is always the profit margin that the solar company wants to make which can vary if there are any complications in regard to rooftop access or unforeseen obstacles, for example.

Your installer will explain each of the solar panel tax credit available in Idaho and how to apply for them.

Solar Panel Calculator: Requirements and Cost Savings

Solar power information is power, so to speak.

If you want to calculate your own costs and where you can make reductions to reduce the overall price, there are formulas and online energy calculators that you can use.4

The first thing to do is to calculate your power consumption.

A typical household in Idaho consumes 961 kWh every month, 11,532 kWh per year.12 Another important factor to be aware of is the peak sun hours a day, and in the state of Idaho that is between 4.92 to 5.67 hours of peak sun a day.

If that is rounded up to 5 hours and we estimate that the average-sized solar panel of 400 kWh is going to be used, then some math can be applied to determine how many panels you will need for your property.

Peak daily sun hours (5) X 30 days = 150 peak sun hours a month

Monthly electricity usage (961) / monthly sun hours (150) = 6.41 kW

To convert 6.41 kW to Watts, multiply by 1,000 = 6,410 watts

Divide the watts (6410) by the watts of one solar panel (400) = 17 solar panels

The actual formula would look like this:

- 5 X 30 = 150

- 961 / 150 = 6.41

- 6.41 X 1,000 = 6,410

- 6,410 / 400 = 16.025 solar panels

Note that rounding up the value to determine the number of panels will ensure that the remaining small fraction is met as well.

It is also important to remember that solar panels are originally rated in a factory environment where the conditions are perfect. In a real-world setting, the actual output will be less because not every day is going to be perfect sunshine weather.

Therefore to compensate for this discrepancy when calculating how many solar modules you are going to need, multiply the end figure by 25%, which will bring the amount to 22 solar panels.

To get a more accurate assessment you can, of course, use the calculator below.

If after doing all the math, punching all those buttons, inputting all your data, and deciphering how solar tax credits work to reduce the costs, a solar panel system is still beyond your budget, what can you do?

Although it’s not possible to compromise on the quality of the solar panels, some adjustments can be made to save a few thousand here and there.

Some homeowners find ways of reducing the energy they consume by using less power-hungry appliances, enrolling in a net metering program, or opting to use a PPA to eliminate any upfront costs.

How To Find ID Solar Panels

There are just over 40 solar panel suppliers servicing a population in Idaho that is just shy of 2 million people,7 spread over a surface area of 83,569 square miles (216,440 sq km). That includes 4 manufacturing factories and 24 companies that focus solely on installing the products.

To discover the best solar installer for your specific requirements, it is important to do some research. Not all solar panels are the same size, and neither are all rooftops.

Just because your power needs are high doesn’t mean that your roof can accommodate all the solar panels. Which may result in some being ground-mounted or some wall-mounted solar panels installed as well.

This quick checklist will help you to make the correct choices:

- Use an online calculator to estimate the cost and amount of panels you are likely to need, ensuring that all permit costs, mounting brackets, inverters, battery packs, and your state’s daily peak sun hours.

- Do your research and make a list of questions to ask the companies. And then shop around and get several quotes for comparison purposes.

- Check how many years the company has been installing solar panels and if they are North American Board of Certified Energy Practitioners (NABCEP). This certification will indicate their level of expertise.

- Always check the paperwork of the company to see if they are fully licensed installers – and fully insured. Accidents can happen but the last thing you will want is an extra expense that is not your fault and caused by negligence.

- Don’t be shy about asking if they have done any other jobs in your area or if you can go and inspect one of their previous installations.

- Warranties are important. Read the fine print to see what their responsibilities are within the warranty time period, and that the company will still be around in 20 years.

Looking back on their track record will be an indication of whether they will still be in business when you need them in the years to come.

With a favorable amount of daily peak sun hours, Idaho is an excellent state for adopting solar energy.

This renewable power source is accessible to homeowners and businesses alike, offering benefits such as reduced electricity costs and a smaller carbon footprint, and thanks to Idaho solar incentives, making the move is less expensive than ever before.

Frequently Asked Questions About Idaho Solar Incentives

Why Are Solar Panels Bad and Are Solar Panels Toxic?

How are solar panels disposed of in landfills in Idaho potentially causing hazardous materials to leak into the local ecosystem, and this labels solar panels as bad for the environment at the end of their useful life. However, new recycling centers are emerging in Idaho to recondition old solar arrays and this answers the questions “why are solar panels bad?” and “are solar panels toxic?”8

What Does a Solar Panel Do and What’s PV Mean?

So, what does a solar panel do and what’s PV stand for? A solar panel system absorbs solar energy through silicon cells on the face of the photovoltaic (PV) panels and converts the energy into usable electricity.

What Are Solar Panels Made of in Idaho?

Solar panels, USA, are made up of mostly glass, 76%, aluminum, plastics, silicon, copper, and other metals such as silver and iron. This composition answers the question, “what are solar panels made of?”

References

1George Washington University. (2023, March 22). The Inflation Reduction Act’s Climate and Energy Provisions: A Six-Month Report. American University. Retrieved September 1, 2023, from <https://www.american.edu/spa/cep/inflation-reduction-act.cfm>

2Solar Energy Technologies Office. (2023, March). Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics. Energy Efficiency & Renewable Energy. Retrieved September 1, 2023, from <https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics>

3U.S. Department of Energy. (2023). Charging Electric Vehicles at Home. U.S. Department of Energy. Retrieved September 1, 2023, from <https://afdc.energy.gov/fuels/electricity_charging_home.html>

4Energy Saver. (2023). Estimating Appliance and Home Electronic Energy Use. Energy Efficiency & Renewable Energy. Retrieved September 1, 2023, from <https://www.energy.gov/energysaver/estimating-appliance-and-home-electronic-energy-use>

5US Environmental Protection Agency. (2023, February 5). Solar Power Purchase Agreements. US Environmental Protection Agency. Retrieved September 1, 2023, from <https://www.epa.gov/green-power-markets/solar-power-purchase-agreements>

6Solar Energy Technologies Office. (2023, August). Federal Solar Tax Credits for Businesses. Energy Efficiency & Renewable Energy. Retrieved September 1, 2023, from <https://www.energy.gov/eere/solar/federal-solar-tax-credits-businesses>

7Governor’s Office of Energy and Mineral Resources. (2022, November 9). Solar. Idaho.gov. Retrieved September 1, 2023, from <https://oemr.idaho.gov/sources/re/solar/>

8U.S. Environmental Protection Agency. (2023, June 20). Solar Panel Recycling. EPA. Retrieved September 1, 2023, from <https://www.epa.gov/hw/solar-panel-recycling>

9Energy Sage. (2023, September 9). Idaho solar panels: local pricing and installation data. Energy Sage. Retrieved September 11, 2023, from <https://www.energysage.com/solar-panels/id/>

10Idaho Government. (2023, June 28). Rebates & Incentives. Idaho Governor’s Office of Energy and Mineral Resources. Retrieved September 11, 2023, from <https://oemr.idaho.gov/financial-information/incentives/>

11Ramasamy, V., Zuboy, J., O’Shaughnessy, E., Feldman, D., Desai, J., Woodhouse, M., Basore, P., & Margolis, R. (2022, September). U.S. Solar Photovoltaic System and Energy Storage Cost Benchmarks, With Minimum Sustainable Price Analysis: Q1 2022. NREL. Retrieved September 11, 2023, from <https://www.nrel.gov/docs/fy22osti/83586.pdf>

12U.S. Energy Information Administration. (2021). 2021 Average Monthly Bill-Residential. EIA. Retrieved September 11, 2023, from <https://www.eia.gov/electricity/sales_revenue_price/pdf/table5_a.pdf>

13Internal Revenue Service. (2023). Form 5695. IRS. Retrieved September 14, 2023, from <https://www.irs.gov/pub/irs-pdf/f5695.pdf>

14Idaho State Tax Commission. (2023). Form 39R Resident Supplemental Schedule. Idaho State Tax Commission. Retrieved September 13, 2023, from <https://tax.idaho.gov/wp-content/uploads/forms/EFO00088/EFO00088_12-30-2022.pdf>

15United States Securities and Exchange Commission. (2023). Form 40F. United States Securities and Exchange Commission. Retrieved September 13, 2023, from <https://www.sec.gov/files/form40-f.pdf>

16Dominion Energy Utah. (2023). ThermWise Rebates. Dominion Energy. Retrieved September 13, 2023, from <https://www.thermwise.com/rebates/>

17Photo by Jared Heidemann. Energy.gov. Retrieved from <https://www.energy.gov/eere/solar/federal-solar-tax-credits-businesses>